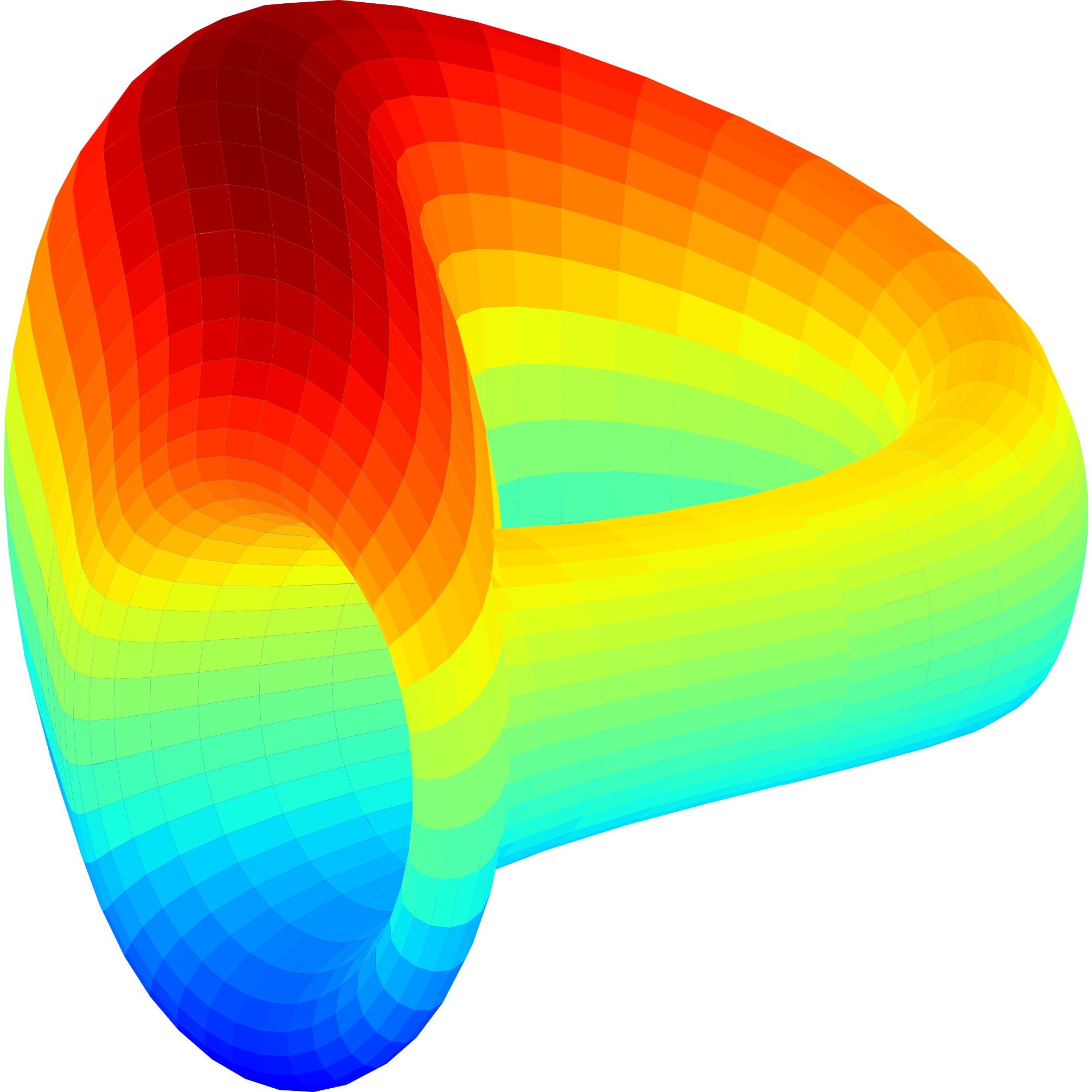

Curve Finance is a decentralized exchange (DEX) designed specifically for stablecoin trading. Leveraging advanced algorithms, it provides liquidity to users while maintaining low fees and low slippage, ensuring stable asset swaps.

Understanding Curve Finance: An Insight into Its Structure and Functioning

Curve Finance is built on the Ethereum blockchain, and it offers several features:

- Automated Market Makers (AMMs): It employs an algorithm that reduces the price impact and provides liquidity to traders, even with significant trade volumes.

- Stablecoin Support: Primarily focused on stablecoins, it enables low-cost swaps between different stable assets.

- Yield Farming: Liquidity providers can earn CRV tokens, Curve’s native token, and participate in yield farming to maximize returns.

- Integration with Other Protocols: Curve integrates with various other DeFi protocols, providing a seamless experience for users.

Proxies and Curve Finance: A New Horizon in Decentralized Trading

Proxies can play a vital role in the Curve Finance ecosystem. Here’s how:

- Privacy Enhancement: By hiding the user’s real IP address, proxies provide an additional layer of privacy and security.

- Access Management: Proxies can facilitate access to the Curve platform from regions where it might be restricted.

- Load Balancing: Efficient proxy services can distribute traffic and reduce the latency during high demand, ensuring a smooth trading experience.

The Benefits of Using a Proxy in Curve Finance: A Comprehensive Look

Using a proxy in Curve Finance offers several advantages:

- Anonymity: Keeps transactions private by masking the user’s original IP.

- Accessibility: Allows access from restricted regions.

- Enhanced Security: Adds an extra layer of protection against potential attacks.

- Performance Optimization: Can improve the response times through load balancing.

Potential Challenges: What You Should Know When Using a Proxy in Curve Finance

Though proxies offer many benefits, some challenges may arise:

- Compatibility Issues: Not all proxies may work seamlessly with the Curve platform.

- Potential Latency: Incorrectly configured proxies might increase response times.

- Security Concerns: Using unreliable proxies might expose sensitive information.

- Legal and Compliance Issues: Ensuring compliance with local laws and regulations is vital when using proxies.

Why Choose OneProxy? The Best Proxy Server Provider for Curve Finance

OneProxy stands out as the ideal proxy server provider for Curve Finance due to:

- Tailored Solutions: OneProxy offers customized solutions specifically designed to work with Curve Finance.

- High-Speed Servers: With a global network of high-performance servers, OneProxy ensures minimal latency.

- Robust Security: Advanced encryption and security protocols to keep your transactions private and secure.

- 24/7 Customer Support: Expert support available around the clock to resolve any issues promptly.

- Compliance Assurance: OneProxy’s services are fully compliant with international laws and regulations, making it a trustworthy choice for users worldwide.

In summary, whether for privacy, accessibility, or performance, OneProxy’s tailored solutions make it the go-to choice for users looking to leverage the power of Curve Finance through proxies.